1 novembre 2023

Kinktober 2023

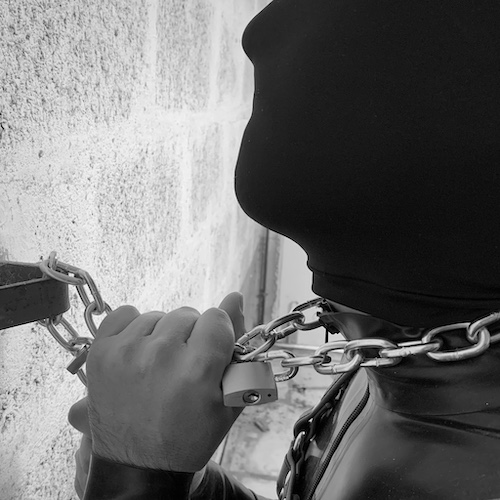

Un petit résumé de ma participation à kinktober 2023. Le principe : publier chaque jour sur les réseaux sociaux un texte, un dessin ou une photo en rapport avec un thème imposé. Je n’avais pas le temps ni les moyens de produire une photo par jour, je me suis donc limité aux jours où j’avais dans mes archives quelque chose qui pouvait coller.

Commentaires

Poster un commentaire

Les commentaires sont désactivés sur cette entrée.

**Understanding the Vital Role of Cook County’s DPA in Property Tax Relief**

Navigating the complexities of property taxes in Cook County can be overwhelming,

especially for homeowners who may be struggling to understand

their assessments or feel they are being overcharged.

That's where the Cook County Department of Property Assessments (DPA) comes in. Serving as a crucial resource for residents, the DPA is committed to ensuring transparency, fairness,

and accessibility in property tax assessments.

### What is the Cook County DPA?

The Cook County DPA is an essential arm of local government, responsible

for overseeing property assessments across the

county. Its primary role is to evaluate properties and assign them a fair market value, which serves as the

basis for property taxes. The department’s work directly impacts the tax bills homeowners receive, making it a pivotal entity in maintaining equity within the community.

### How the DPA Supports Homeowners

1. **Property Tax Appeals**: If a homeowner believes their

property has been over-assessed, the DPA provides a formal appeals process.

This allows residents to contest their assessments and potentially lower their property tax burden.

2. **Exemptions and Relief Programs**: The DPA administers various exemptions and

relief programs designed to reduce property tax obligations.

These include exemptions for seniors, veterans, and disabled persons, as well as the general

homeowner exemption, which offers significant savings.

3. **Educational Resources**: Understanding property

taxes can be daunting. The DPA offers a wealth of educational resources, including workshops, online guides, and one-on-one

consultations, to help homeowners comprehend the assessment process and their

tax responsibilities.

4. **Transparency and Accessibility**: The DPA is committed to making the property tax process as transparent as possible.

This includes providing easy access to property

records, assessment data, and detailed explanations of how assessments are determined.

### The Importance of Staying Informed

For Cook County residents, staying informed about property assessments and

the role of the DPA is crucial. By understanding the services offered by the DPA, homeowners can take proactive steps to ensure their assessments are accurate and that they are taking full

advantage of available exemptions and relief programs.

Whether you're a new homeowner in Cook County or have been living here

for years, the Cook County DPA is your partner in navigating the property tax landscape.

Stay informed, stay engaged, and make sure your property taxes reflect the true value of your home.

For more information, visit the Cook County DPA website at https://cookcountydpa.org/